Contact Us

The Alberta oil sands – once forsaken, now highly coveted. This is the sentiment of energy investors and producers alike. Aside from the economic tailwind, the age of AI and machine learning is putting a further shine on our province’s economic powerhouse natural resource. In a paper published in early 2023 in the SPE Journal, authors from Cenovus Energy, and the University of Alberta details how AI can be used to forecast oil sand production.

Oil is an important resource used everywhere from transporting food from the farm to your local grocery stores, to ensuring that people get to the places they need to go, be it plane, train or automobile.

Previous to 2022, inflation was an academic concept taught in history when we learned of hyperinflation in post-WWI Germany and in economic classes when learning about monetary and fiscal policies. Energy contributes roughly 1/4 to inflation and while the low oil price years from 2014-2020 were miserable for the Canadian energy industry, consumers reaped the benefits of low inflation. Unfortunately today in 2023, the Central Banks need to raise interest rates to fight the inflation dragon. The 0% for 24 months financing for the new iPhone or 0.99% financing for 5-years for the newest Civic were the sights of a bygone era.

The inflation genie was kept in its bottle for many years, but the duality of supply-push and demand-pull price increase from the pandemic induced supply chain bottleneck, and excess consumer demand arising from loose central bank policies freed the inflation genie. The multi-year of underinvestment in exploration & development (e&p) in the energy industry when companies were using capital to stave off bankruptcy, instead of investments, during the dry spell for oil price have caused oil price to surge back to decade high levels since the start of 2022.

The combination of fracking technology and low-interest rates allowed US shale drillers with easy access to capital to extract seemingly limitless oil in the latter decade of the 2010s. With the cost advantage of shale drillers, costing ~$60 a barrel, versus ~$76 for the Alberta oil sand producers in 2015, many US majors like ConocoPhillip, Marathon, Devon, and Equinor lost interest in Alberta's oil sands and sold them to Canadian producers.

Despite the cost advantage of shale oil, its biggest drawback is its rapid decline rate where producers are on a perpetual treadmill, where they need to continuously drill and frack to churn production. In contrast to shale oil that has a low upfront cost, but high incremental cost, oil sands have high upfront costs, but low incremental cost due to the oil sands geology, where vast quantity of oil is packed with pay dirt.

The recoverable amount of oil from oil sands is enormous relative to the amount recoverable from shale oil. To put into perspective, Chevron is the largest shale producer and its Permian shale asset 2P Reserve Life Index (RLI), a measure of the number of years recoverable from current production, is ~15 years. Athabasca Oil, which holds the largest Canadian oil sand position, has an estimated 1P RLI of ~40 years and has an estimated 2P RLI of up to 100 years.

Today, the cost advantage has shifted back to oil sand energy’s favour, which with technology, has driven the breakeven cost from ~$76 in 2015 to ~$46 in 2023 in Brent pricing. The oil sands are once again seen with renewed interest with its cost advantage, minimal exploration risk, and ultra long reserve life.

Oil can be generally classified as light, medium or heavy. Light oil is like water where if you put it upside down, the glass empties right away, and is abundant in southeastern in Saskatchewan , and Central/South Alberta. Once an oil deposit is identified, it can be easily recovered. Medium oil is like cold KFC gravy where the thickness prevents it from emptying all at once if poured, and heavy oil is like oatmeal where it’s caked up when it’s cold and sticks to sides of the bowl and would come out in clumps if you tried pouring it out of a bowl. The Montney formation in northeastern BC and the Shaunavon formation in southwestern Saskatchewan are abundant in medium-grade oil. Oil sands are of the heavy oil variant, which are abundant in Northern Alberta near Edmonton and Fort McMurray.

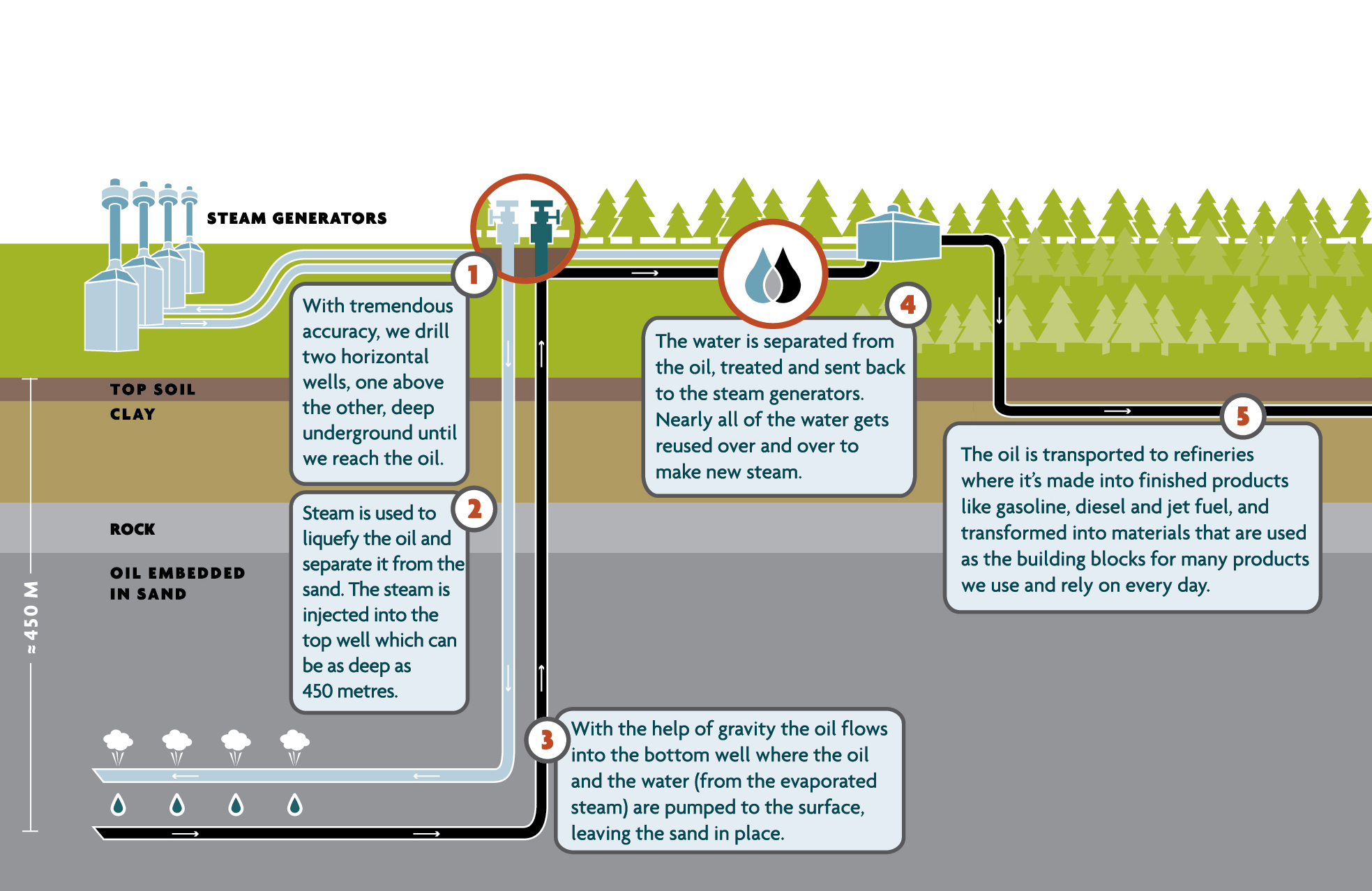

To exploit oil from oil sands, steam-assisted gravity drainage (SAGD) is used to “pull” oil out of the ground. It works by first drilling two wells into the ground and high pressure steam is injected into the top well to heat the oil, similar to heating up oatmeal in a microwave, to reduce its viscosity (a measure of how free-flowing the liquid is where the higher the measure the harder it is to move and vice versa). It takes roughly a month for oil to melt in the steaming process from the rocks. The oil is then dripped into the lower well where it is collected, and pumped up to the surface.

Reliable production forecasting is critical for oil companies for numerous scenarios, including financial and operational planning for how much money can be expected from the sales of the production, how much natural gas cost a company can expect to incur to generate the steam for injection, and the associated greenhouse gas emitted for ESG reporting, as well as the labour planning required to sustain a certain level of production, etc. Operationally, it is important know how much steam to inject into the injection well to optimize production.

While it may sound ideal to pump as much as possible increase oil production, the oil pump in the producing well can only run at a certain speed to push the oil to the surface. Too much steam pumped and you risk over-burning natural gas, and needlessly emit greenhouse gas, where it takes two barrels of steam for each barrel of oil production, and too little steam pumped and you risk underproducing at the optimal rate. Therefore, having real-time information of the performance of the well is vital from an operational, economical and environmental standpoint.

In conventional oil recovery, production type-curve is used to predict the production of a new well, which is based on the historical profile of wells in the area and formation. For oil sands, the Butler model is used to estimate the production of a well-pair based on a unit of time using oil permeability, gravity level, oil viscosity, oil saturation change, reservoir porosity, reservoir material, and reservoir thickness. As in any statistical, or mathematical model, operational constraints and uncertainties are often not considered for the model, and input parameters are sometimes unknown and need to be estimated, both of which lead to inaccurate estimates that have downstream negative effectives for planners, who need accurate real-time data.

To address the operational uncertainties and static parameter limitation nature of the Butler model, authors from the University of Alberta and Cenovus proposed a machine-learning workflow for real-time forecasting. The approach consists of using unsupervised learning to identify similar geology a new well pair can expect to be operated in, and supervised learning using random forest to forecast the oil production rate. The decision to use random forest over other supervised learning algorithms is that it is less computational intensive, but at the expense of reliance on domain expertise, which the authors possess.

For the Paper’s experiment, data was collected consisting of 3-years (1,000-day) period from 152 Christina Lake and Foster Creek well pairs.

Principal Component Analysis (PCA) is a statistical technique used to identify the predictive variables of a large dataset, eliminating variables that have little to no predictive contribution, and identify the optimal number of clusters for k-means clustering. The workflow begins by reducing 15 static variables to 6 variables, where these six variables explain 80% of the data variance, and is the optimal number of clusters PCA identified.

Next, the K-means clustering algorithm is used to group wells of similar geological properties together. The purpose of clustering is that wells of similar geological properties are expected to perform similarly.

Once the well pair groupings are identified, the data from the well-pairs in each of the groups are trained. From the 3-year of data, 90% of the data is used for training, and 10% is used for prediction. To account for uncertainties, Monte Carlo simulation is used to provide the confidence band of the prediction.

In the early stage of the SAGD process, there is no operational data, so only geological data is used to make prediction of the production. But as more operational data comes online from the new well-pair, the new data is used to reclassifying the well-pair using k-means. The new data is also used to retrain the random forest model in real-time and new predictions are made. This cycle moves back-and-forth continuously throughout the life of the well.

In the first 100 days of a new well-pairs’ life, most of the actual predictions for the steam and the oil models are higher than that of the prediction, but still lies within the prediction’s confidence band. But as more data comes online and the model learns more about its geological properties, the predictions become highly accurate. After that, the predictions are almost identical to that of the actual rates. Below are the performance of both the steam and oil models, where you can see that the model becomes highly accurate as time elapses.

With the popularity of EVs and the world's transition to renewable energy, many write off the oil industry as a dirty, sunset industry lacking in innovation, like Big Tobacco of the yesteryears. However, oil is as important today in powering our economies and helping developing economies industrialize as it did a century ago. While we have to balance economic growth, and environmental protection, it’s a win for our economy and the environment when oil can be produced economically and sustainably with reduced natural gas burned and CO2 emitted with new innovative AI approaches like this from both our Alberta energy campion, Cenovus Energy, and world-renowned AI and energy academia powerhouse, the University of Alberta.